Eine Milliarde US-Dollar ist laut den Risikokapitalmarktanalysten von CB Insights 2016 in Startups im Automobilsektor weltweit geflossen. Das ist noch vergleichsweise wenig.

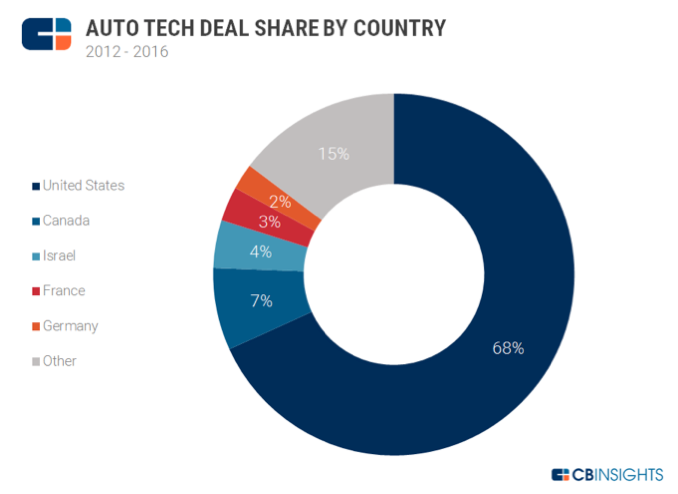

Deutschland lag den Zahlen von CB Insights zufolge 2016 mit gerade einmal 2% auf den hinteren Rängen, sogar noch hinter Frankreich:

Da China nirgendwo auftaucht, sollte man die Aufzählung allerdings mit Vorsicht geniessen.

Taking a look at global deal distribution since 2012, the United States remains a central force with 68% of all deals and both auto tech unicorns Quanergy and Zoox based in Silicon Valley.

However, several other countries have a strong presence as well, such Canada, which plays host to startups like LiDAR developer LeddarTech, computer vision company Algocian, and connected car provider Mojio. Israel, the home base of Mobileye, has also seen the rise of automotive cybersecurity startups like Argus as well as other sensor companies like Oryx Vision. V2X and V2I developer Autotalks also raised a $25M round from Magma VC just before the close of 2016.

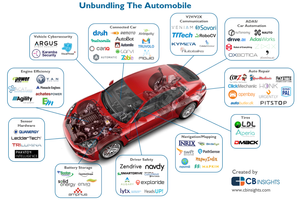

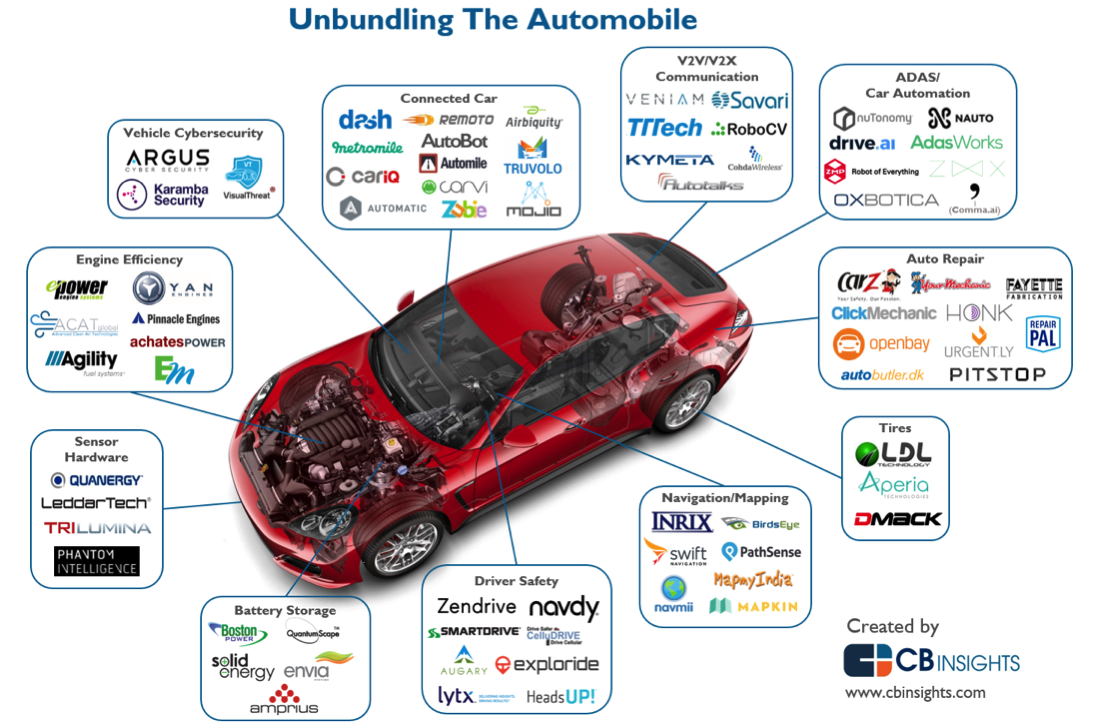

Letztes Jahr hat CB Insights einen guten Überblick über Cartech-Startups veröffentlicht:

In March, General Motors put its stake in the ground in the realm of driving tech startups with its acquisition of Cruise Automation. Cruise had raised just $18.8M, but GM valued the company at over $1B.

Media and investor interest in startups working on self-driving or ADAS (advanced driver assistance systems) tech has since exploded, with companies like comma.ai, Nauto, nuTonomy, and others garnering headlines and raising funding.

While self-driving tech — which is included in the infographic above — receives the lion’s share of media attention, a host of less-heralded startups are targeting specific pieces of automotive infrastructure or components. For example, companies including Quanergy, LeddarTech, and TriLumina are seeking to capitalize on the self-driving revolution by dramatically lowering the cost of expensive LiDAR sensors.

Startups such as Veniam and Savari are developing vehicle-to-vehicle (V2V) and vehicle-to-anything (V2X) communications, another autonomous-adjacent technology field. With increasing automotive connectivity seemingly inevitable, vehicle cybersecurity has also begun to emerge as a focus, with newer players like Karamba Security joining others such as Argus Cyber Security.