How about that.

Die offizielle Site von Social Capital:

Data is in our DNA at Social Capital. As operators, we used it to grow some of the world’s most successful technology companies. As investors, we use it to reach conviction for investment decisions.

A few years ago, we open-sourced some of our data-driven diligence methodologies. We’re now building “capital-as-a-service” (CaaS) with the goal of democratizing access to capital. Through CaaS, we’ve analyzed thousands of companies and invested in dozens. We’re currently in private beta, but soon entrepreneurs around the world will be able to apply for capital based on what they’ve built versus who they know or what they look like.

Und hier etwas Hintergrund zu ihrem "Capital-as-a-Service"-Ansatz:

Many of the world’s hardest problems are felt unevenly across the globe, and often the entrepreneurs with the most context, the most authenticity, the most expertise, and the most drive to solve them sit closest to the problems themselves. From connectivity to labor market efficiency to healthcare access, many of these problems aren’t acutely experienced in the small number of financial hubs around the world. And, the entrepreneurs best positioned to solve these problems don’t always look or sound a certain way, don’t always mingle with the right people, don’t always know the secret handshake. So, many of these ideas, many of these entrepreneurs, many of these teams struggle to raise meaningful amounts of capital. I’ve met with founders and teams on six continents, and I can tell you from personal experience that they don’t struggle to raise capital for lack of talent or drive or ingenuity, they struggle because they don’t match the traditional mental model of a Silicon Valley VC deal. [...]

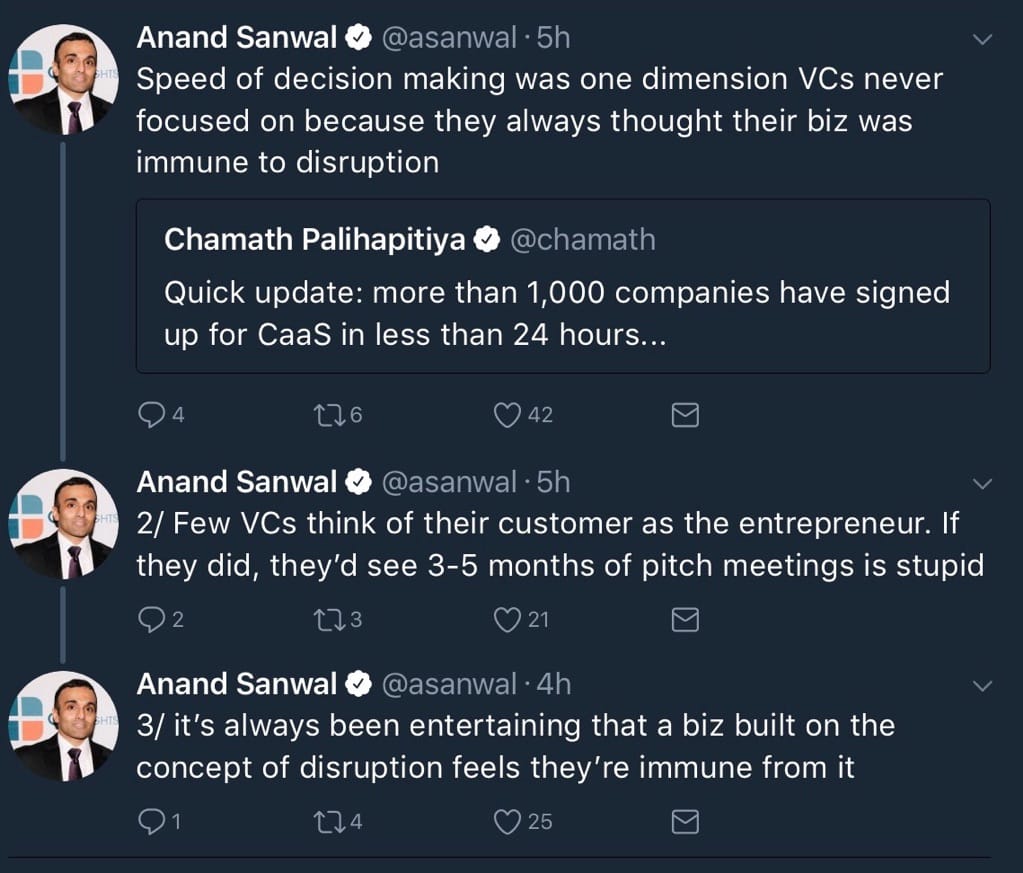

The reason that too many dollars are chasing too few opportunities is because the anatomy of traditional venture capital hasn’t changed in the past 30 years. Face-to-face interactions and human judgement, followed by (at best) a few thin Excel models and relationship-driven diligence creates a high propensity for bias and a low propensity for scale. This is a classic example of a sector ripe for disruption. [...]

Capital-as-a-service will run over-the-top and allow us to scale to new geographies and sectors. [...]

In our pilot, we evaluated nearly 3,000 companies and committed to funding several dozen of those, across 12 countries and many sectors, without a single traditional venture pitch. In fact, in most cases the data-driven approach allowed us to reach conviction around an investment opportunity before we ever even spoke to the founders. Worth noting that when we recently looked at CEO demographics, we found that 42% were female and the majority nonwhite.

(Hervorhebung von mir)

Ansätze wie dieser und ICOs (800 Millionen $ in Q2 2017) und Anbieter wie Angellist (siehe auch mein Podcast-Interview mit Philipp Moehring von Angellist von 2014) und deren neuer Ableger Coinlist bringen Disruption zu denen, die gern Disruption in andere Branchen bringen und daran fürstlich verdienen: Risikokapitalgeber.

Es ist ein technologiegetriebenes Ende der Gatekeeper. Klingt bekannt?